DSK is a liar.

He doesn’t shy away from lying anywhere. Clients and media are his soft targets but he doesn’t hesitate to lie in courts also.

But is he sociopathic liar?

Sociopathic liars are pathological liars. They lie to gain something. Worse yet, their lying is usually calculated and cunning.

A sociopath doesn’t care who their lies affect, as long as in the end the lie fits their purpose and they get what they want.

Pathological liars know the difference between right and wrong, and they consciously recognize that lying is wrong.

Unfortunately, they don’t really care. In fact, they are so good at lying, many times they become their own lie.

Let us see some examples related to DSK.

|

| image courtsey datingasociopath.com |

As admitted by DSK only media is his weak point.

DSK and his wife’s anticipatory bail are pending in Bombay high court and next hearing is on 23rd November.

High court has given both reliefs from arrest under certain condition that they shall not tamper with the evidence and/or pressurize or threaten the prosecution witnesses.

Even then they not only hold press conference, they made misleading statement about their assets and liabilities and also appealed investors.

Addressing a press conference, DSK said the total assets of the firm stood at Rs 9,000 crore whereas the dues including the fixed-deposit (FD) returns are "merely" Rs 1500 crore.

He revealed that a foreign investor has shown willingness to form a joint venture with the firm in the ambitious DSK Dream City Project, worth Rs 13,000 crore.

Aren’t these statements a part of tactics to pressurize or threaten investors and contempt of court?

DSK also shared video of his press conference on social media.

DSK never shy away from making misleading statement in court.

In an application filed in Pune court they stated that things were perfect for the DSK Group till 2008, when the Lehman Brothers declared bankruptcy and European markets crashed. Just before the two developments, the couple stated that they had tied up with an Israel based GCC Ltd for developing a special economic zone (SEZ) spread over 300 acres.

However this was completely untrue.

Actually DSK had got in-principal approval for SEZ in June 2007 however in was never totally approved.

In fact in 38th meeting of the SEZ Board of Approval DSK’s SEZ proposal was rejected on 11th February 2010.

The proposal of SEZ was rejected because during inspection a number of issues arose such as the contiguity of the SEZ had been broken, presence of an irrigation canal.

Then in April 2010 SEZ proposal was withdrawn by DSK .

However while talking to press DSK had said that new norms of the SEZ were not conducive to the company and hence they withdrawn.

It is another thing that DSK had purchased all lands claiming for SEZ / Township purpose.

http://indianexpress.com/article/cities/pune/dsk-pulls-out-of-phursungi-sez-plan/

Then in 2012 they obtained approval for Special Township.

Thereafter DSK launched Dream City, raised FDs for it, obtained construction loan, accepted flat bookings.

Lehman Brothers declared bankruptcy and European markets crashed in September 2008, then how come these two factors did affect dream city project?

DSK’s press conference (PC) was also full of lies.

Only positive outcome of this PC was kin took on DSK.

In PC DSK referred to several internal documents of the group that were uploaded on blogs that he believed led to panic among investors.

When media asked him about answering the issues rose on this blog he said Vijay Kumbhar didn’t pick the documents from our drawer all the documents are in public domain.

However immediately after this DSK said that my brothe’s son-in-law, Kedar Vanjpe is responsible for all this mess. He used to work as the executive director in the company. We bought the land on his wife’s name, who is my niece. He was disturbed since my son (Shirish) joined the company and he provided information to Vijay Kumbhar.

As soon as word got out that DSK was accusing Vanjpe of sabotage vanjpe demanded a public apology from DSK, stating that he will initiate legal action if DSK fails to do so.

Immediately after Vanjpe’s challenge DSK’s son in law Sanjay Deshpande slapped some question to DSK.

1. DSK sir have you asked Kedar Vanjape and has he allowed you to buy dream city land on name of his wife ? Or even your other relatives?

2. Does Kedar Vanjpe told various banks of financial institutes to publish acquisition notices to your group companies which has been failed to repay huge loan amounts? Every day newspapers are carrying it.

3. Does Kedar Vanjpe controls all IGR or SEBI web site as you say Kedar gave all documents to Mr.Kumbhar while Kumbhar’s blog says all documents he has got from web sites of government institutes?

4. Does your current financial problems are due to Kedar Vanjape?

5. You said Kedar Vanjpe left DSK group because of your son but Mr.Shirish joined DSK group in 2010 while Kedar left in 2008.

6. Do you mean Kedar Vanjpe is the cause for closing down your toyota dealership? Your sites are dead since last 2 years; huge loans/ FD have been taken on the companies which have no projects on them, your sharing of commissions in crores of rupees in your family under name of flat selling n such services & all these decisions r by Kedar Vanjpe?

7 . You said in press conference you don’t use investors or brokers money but but share profits with FD holders then is it Kedar who gave brokerage documents on name of Hemanti Phadke and her partnership companies by DSKDL which are signed by Hemanti Kulkarni who is director of public limited & is it Kedar Vanjpe who exposed both are same person only?

8 . is it Kedar Vanjpe and not your CA who wrote to SEBI that your company is doing bad business and in no position to repay the debenture money?

Sanjay Deshpande further advised DSK that instead blaming some Vanjpe , Kumbhar or Karandikar for your failures or even our PM Modi for demonetization and bad state of real estate, accept that you are a bad businessman & you fooled many till now under your image of DSK and when that mask is torn and your true face is exposed you are blaming others for showing your reality!! instead of doing such drama tell people your actual loans as well real condition of your assets and be ready for the punishment of your sins, like a real man which off-course you are not!!

Sanjay Deshpande and Kedar Vanjpe almost confirmed all the allegation of money siphoning, forged signs, shell companies , murky deals made in my earlier post “ DSKDL a public limited company or criminal enterprise ?”

It is not the case that DSK cheated only relatives. He didn’t spare anybody including Government agencies, his customers, suppliers’ and banks also .

He always discovered new Ideas of lying and cheating.

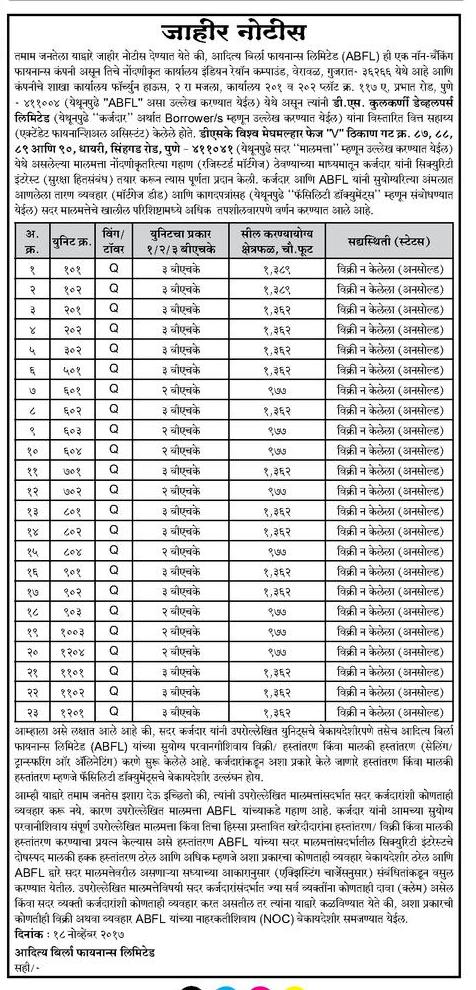

Recently an advertisement was published in newspaper by Aditya Birla Finance Company ( ABFL)

The advertisement claimed that some flats in Meghmalhar scheme at Dhayari were mortgaged to the company by DSK . However company found that DSK was trying to sell those flats. Company also warned any transaction towards thos flats would be illegal.

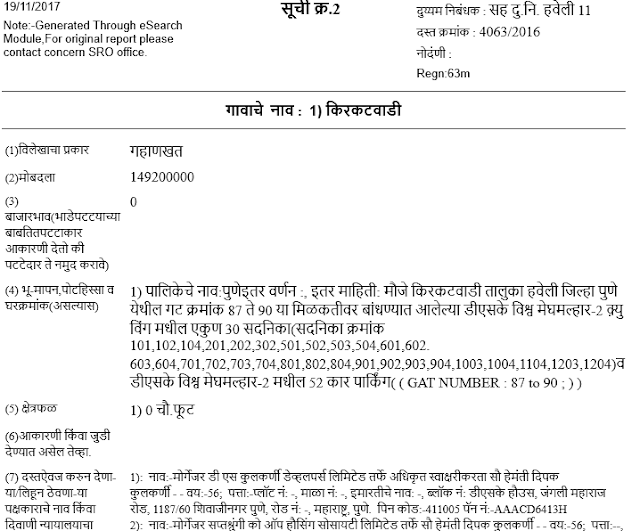

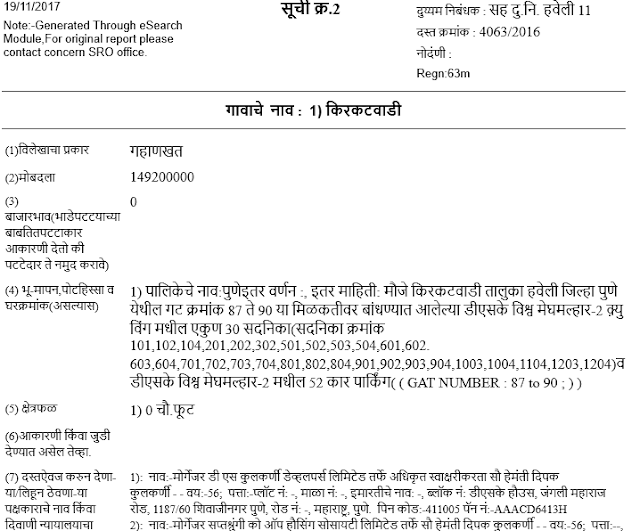

In April 2016 DSK mortgaged 30 unsold flats and 52 car parkings of Q wing of DSK Vishva Meghmalhar scheme to ABFL for 14.92 crores . The flat numbers were 101,102,104,201,202,302, 501, 502, 503,504,601,602,603, 604, 701,702,703, 704 801,802,804, 9 01, 9 02, 9 03, 9 04,1003,1004 ,1104, 1203,1204.

Even though DSK knew that flats were already mortgaged he sold almost 18 flats to the buyers.

In April 2016 DSK mortgaged 30 unsold flats and 52 car parkings

That was not all.

Perhaps due to non-repayment of the loan or for some other reason in June 2017 for more security ABFL asked three more flats as mortgage.

Surprisingly, despite knowing that many of them have sold them to others, DSK has mortgaged three more flats along with the earlier ones.

despite knowing that many of them have sold them to others,

See another form of lying

The construction of DSK’s Gold leaf project at Baner is at standstill since November 2015 ,.

DSK mortgaged flat at 6th floor of this building for 3.42. crores

Earlier in June 2016, Deepak Sakharam Kulkarni alias DSK bought a 3220 square foot flat DKDL company in June 2016 for a price of Rs. 14186 per sq ft at a price of 4,56,80000 rupees (4 crore rupees eighty thousand rupees) from own company.

Actually market or ready reckoner rate at this place is not more 6000 / per sq ft

flat for a price of Rs. 14186 per sq ft at a price of 4,56,80000 rupees

However later in September 2016 DSK sold 1954 square feet flat at the rate of Rs 7272 per square feet to other buyers. Before June 2016 rates were same or less than this.

For others rate was 7272 rs per sq ft

Then why would have DSK bought flat at the rate of twice the prevailing rate?

The reason was simple. DSK didn’t want flat , he wanted money.

That’s why immediately after seven days he mortgaged this flat to syndicate bank for 3.42 crore rupees and bank too disbursed the loan without taking into consideration prevailing market or ready reckoner rates.

Only DSK can do the bargain for non-existent items.

DSK has already conveyed large part of DSK Vishwa to the Nyaty Builders.

Now more parts of the DSK Vishwa have also been given to the Sakala Builders.

And you know when did this transactions happen?

On the same day when FIR was lodged against DSK under MPID act i.e on 28th October 2017.

While the case was being registered at Shivaji nagar Police station same time at the same time documents were lodged for registration and later on signed on 29th and 31st October.

Now what would you say ?

Related Stories

For More on DSKDL scam read Marathi blogs here

Subscribe for Free

To receive free emails or free RSS feeds, please, subscribe to Vijay Kumbhar's Exclusive News

& Analysis

RTI KATTA is a platform to empower oneself through

discussions amongst each other to solve their problems by using Right to

Information act, Every Sunday at Chittaranjan Watika, Model Colony,Shivaji

nagar, Pune, between 9.30 to 10.30 A.M.

RTI Resource Person, RTI Columnist

Website – http://vijaykumbhar.com

DSK and his wife’s anticipatory bail are pending in Bombay high court and next hearing is on 23rd November.

High court has given both reliefs from arrest under certain condition that they shall not tamper with the evidence and/or pressurize or threaten the prosecution witnesses.

Even then they not only hold press conference, they made misleading statement about their assets and liabilities and also appealed investors.

Addressing a press conference, DSK said the total assets of the firm stood at Rs 9,000 crore whereas the dues including the fixed-deposit (FD) returns are "merely" Rs 1500 crore.

He revealed that a foreign investor has shown willingness to form a joint venture with the firm in the ambitious DSK Dream City Project, worth Rs 13,000 crore.

Aren’t these statements a part of tactics to pressurize or threaten investors and contempt of court?

DSK also shared video of his press conference on social media.

DSK never shy away from making misleading statement in court.

In an application filed in Pune court they stated that things were perfect for the DSK Group till 2008, when the Lehman Brothers declared bankruptcy and European markets crashed. Just before the two developments, the couple stated that they had tied up with an Israel based GCC Ltd for developing a special economic zone (SEZ) spread over 300 acres.

However this was completely untrue.

Actually DSK had got in-principal approval for SEZ in June 2007 however in was never totally approved.

In fact in 38th meeting of the SEZ Board of Approval DSK’s SEZ proposal was rejected on 11th February 2010.

The proposal of SEZ was rejected because during inspection a number of issues arose such as the contiguity of the SEZ had been broken, presence of an irrigation canal.

Then in April 2010 SEZ proposal was withdrawn by DSK .

However while talking to press DSK had said that new norms of the SEZ were not conducive to the company and hence they withdrawn.

It is another thing that DSK had purchased all lands claiming for SEZ / Township purpose.

|

http://indianexpress.com/article/cities/pune/dsk-pulls-out-of-phursungi-sez-plan/ |

Then in 2012 they obtained approval for Special Township.

Thereafter DSK launched Dream City, raised FDs for it, obtained construction loan, accepted flat bookings.

Lehman Brothers declared bankruptcy and European markets crashed in September 2008, then how come these two factors did affect dream city project?

DSK’s press conference (PC) was also full of lies.

Only positive outcome of this PC was kin took on DSK.

In PC DSK referred to several internal documents of the group that were uploaded on blogs that he believed led to panic among investors.

When media asked him about answering the issues rose on this blog he said Vijay Kumbhar didn’t pick the documents from our drawer all the documents are in public domain.

However immediately after this DSK said that my brothe’s son-in-law, Kedar Vanjpe is responsible for all this mess. He used to work as the executive director in the company. We bought the land on his wife’s name, who is my niece. He was disturbed since my son (Shirish) joined the company and he provided information to Vijay Kumbhar.

As soon as word got out that DSK was accusing Vanjpe of sabotage vanjpe demanded a public apology from DSK, stating that he will initiate legal action if DSK fails to do so.

Immediately after Vanjpe’s challenge DSK’s son in law Sanjay Deshpande slapped some question to DSK.

1. DSK sir have you asked Kedar Vanjape and has he allowed you to buy dream city land on name of his wife ? Or even your other relatives?

2. Does Kedar Vanjpe told various banks of financial institutes to publish acquisition notices to your group companies which has been failed to repay huge loan amounts? Every day newspapers are carrying it.

3. Does Kedar Vanjpe controls all IGR or SEBI web site as you say Kedar gave all documents to Mr.Kumbhar while Kumbhar’s blog says all documents he has got from web sites of government institutes?

4. Does your current financial problems are due to Kedar Vanjape?

5. You said Kedar Vanjpe left DSK group because of your son but Mr.Shirish joined DSK group in 2010 while Kedar left in 2008.

6. Do you mean Kedar Vanjpe is the cause for closing down your toyota dealership? Your sites are dead since last 2 years; huge loans/ FD have been taken on the companies which have no projects on them, your sharing of commissions in crores of rupees in your family under name of flat selling n such services & all these decisions r by Kedar Vanjpe?

Sanjay Deshpande further advised DSK that instead blaming some Vanjpe , Kumbhar or Karandikar for your failures or even our PM Modi for demonetization and bad state of real estate, accept that you are a bad businessman & you fooled many till now under your image of DSK and when that mask is torn and your true face is exposed you are blaming others for showing your reality!! instead of doing such drama tell people your actual loans as well real condition of your assets and be ready for the punishment of your sins, like a real man which off-course you are not!!

Sanjay Deshpande and Kedar Vanjpe almost confirmed all the allegation of money siphoning, forged signs, shell companies , murky deals made in my earlier post “ DSKDL a public limited company or criminal enterprise ?”

It is not the case that DSK cheated only relatives. He didn’t spare anybody including Government agencies, his customers, suppliers’ and banks also .

He always discovered new Ideas of lying and cheating.

Recently an advertisement was published in newspaper by Aditya Birla Finance Company ( ABFL)

The advertisement claimed that some flats in Meghmalhar scheme at Dhayari were mortgaged to the company by DSK . However company found that DSK was trying to sell those flats. Company also warned any transaction towards thos flats would be illegal.

In April 2016 DSK mortgaged 30 unsold flats and 52 car parkings of Q wing of DSK Vishva Meghmalhar scheme to ABFL for 14.92 crores . The flat numbers were 101,102,104,201,202,302, 501, 502, 503,504,601,602,603, 604, 701,702,703, 704 801,802,804, 9 01, 9 02, 9 03, 9 04,1003,1004 ,1104, 1203,1204.

Even though DSK knew that flats were already mortgaged he sold almost 18 flats to the buyers.

|

| In April 2016 DSK mortgaged 30 unsold flats and 52 car parkings |

That was not all.

Perhaps due to non-repayment of the loan or for some other reason in June 2017 for more security ABFL asked three more flats as mortgage.

Surprisingly, despite knowing that many of them have sold them to others, DSK has mortgaged three more flats along with the earlier ones.

|

| despite knowing that many of them have sold them to others, |

The construction of DSK’s Gold leaf project at Baner is at standstill since November 2015 ,.

|

| DSK mortgaged flat at 6th floor of this building for 3.42. crores |

Earlier in June 2016, Deepak Sakharam Kulkarni alias DSK bought a 3220 square foot flat DKDL company in June 2016 for a price of Rs. 14186 per sq ft at a price of 4,56,80000 rupees (4 crore rupees eighty thousand rupees) from own company.

Actually market or ready reckoner rate at this place is not more 6000 / per sq ft

|

| flat for a price of Rs. 14186 per sq ft at a price of 4,56,80000 rupees |

However later in September 2016 DSK sold 1954 square feet flat at the rate of Rs 7272 per square feet to other buyers. Before June 2016 rates were same or less than this.

|

| For others rate was 7272 rs per sq ft |

Then why would have DSK bought flat at the rate of twice the prevailing rate?

The reason was simple. DSK didn’t want flat , he wanted money.

That’s why immediately after seven days he mortgaged this flat to syndicate bank for 3.42 crore rupees and bank too disbursed the loan without taking into consideration prevailing market or ready reckoner rates.

DSK has already conveyed large part of DSK Vishwa to the Nyaty Builders.

Now more parts of the DSK Vishwa have also been given to the Sakala Builders.

And you know when did this transactions happen?

On the same day when FIR was lodged against DSK under MPID act i.e on 28th October 2017.

While the case was being registered at Shivaji nagar Police station same time at the same time documents were lodged for registration and later on signed on 29th and 31st October.

Now what would you say ?

Related Stories

For More on DSKDL scam read Marathi blogs here

Subscribe for Free

To receive free emails or free RSS feeds, please, subscribe to Vijay Kumbhar's Exclusive News

& Analysis

RTI KATTA is a platform to empower oneself through

discussions amongst each other to solve their problems by using Right to

Information act, Every Sunday at Chittaranjan Watika, Model Colony,Shivaji

nagar, Pune, between 9.30 to 10.30 A.M.

RTI Resource Person, RTI Columnist

Phone – 9923299199

Website – http://vijaykumbhar.com

Email – admin@vijaykumbhar.com

Facebook - https://www.facebook.com/kvijay14

Twitter - https://twitter.com/Vijaykumbhar62

YouTube - https://www.youtube.com/user/kvijay14